michigan unemployment income tax refund

The Michigan Department of Treasury has posted a notice for taxpayers related to the treatment of unemployment compensation for tax year 2020. When you create a MILogin account you are only required to answer the verification questions one.

2021 Unemployment Benefits Taxable On Federal Returns 13newsnow Com

The state UIA said Monday that 1099-G forms now will be sent.

. Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next. Cash money 100 dollar bills. Please allow the appropriate time to pass before checking your refund status.

5 This is a federal exclusion that reduced AGI at the federal level. Michigan has a flat income tax rate of 425. The rule change only applies for 2020 tax must be.

Mark the post that answers your question by. Ad Learn How Long It Could Take Your 2021 State Tax Refund. The federal American Rescue Plan Act excludes unemployment benefits up to 10200 from income for tax year 2020 for those within certain income brackets providing tax relief on both federal and.

The federal law provides a gross income exclusion of up to 10200 per person for unemployment compensation reported on a 2020 federal income tax return for individuals under certain income thresholds. We use cookiesbrowsers storage to personalize the content and improve user experience. People are filing their tax refunds and because things are clogged up for some of those people those can be garnished said Lisa Ruby a Michigan Poverty Law Program attorney.

Michigan Income Taxes. The State of Michigan has issued a decision on the treatment of unemployment compensation for the 2020 tax year. Check For The Latest Updates And Resources Throughout The Tax Season.

Therefore this income will not be taxed at the year end. Use the MI-1040 and check the amended box. The federal American Rescue Plan Act was signed into law on March 11 2021.

More than 12 million taxpayers who received jobless benefits in Michigan last year can now move forward and file their 2021. Allow 6 weeks before checking for information. There are two options to access your account information.

Account Services or Guest Services. If you earned less than 150000 in modified adjusted gross income you can exclude up to 10200 in unemployment compensation from your income. You pay tax in your home state only.

The federal law provides a gross income exclusion of up to 10200 per person for unemployment compensation reported on a 2020 federal income tax return for individuals under certain income thresholds. These stimulus payments are not considered as taxable but a refundable credit of your income tax return. Taxpayers who filed an original return and either claimed a refund or paid with their return will need to file an amended return to claim their entitled refund.

Report unemployment income to the IRS. Up to 10200 of unemployment benefits will tax exempt in conformity with IRS treatment. 5 This is a federal exclusion that reduced AGI at the federal level.

Michigan officials arent sure how many Michiganders are owed state unemployment tax refunds Leix said. However you dont pay tax in Michigan on unemployment if you no longer live in Michigan. Michigan releases key tax forms for those who were jobless last year.

Generally in the first two years of a businesss liability the tax rate is set by law at 27 except for employers in the construction industry whose rate in the first two years is that of the average employer in the construction industry which is announced by UIA early each year. Photo by Edward Pevos MLive The IRS is sending nearly 4 million more refunds to people who overpaid taxes on unemployment benefits before the passage of the 19. Be sure to check the box on Form MI-1040 line 31A and include any refund received from the original return and provide the explanation as to why the return is being amended.

The amount of income taxes withheld from unemployment revenues spiked to 557 million in the 2020 fiscal. Say Thanks by clicking the thumb icon in a post. The refunds are only for people with a gross income under 150000 and only counts toward the first 10200 of unemployment earnings in 2020.

If you use Account Services select My Return Status once you have logged in. This Notice is an update to the Notice published April 1 2021 and provides guidance to taxpayers. Ad File unemployment tax return.

Previously taxpayers were encouraged to wait to make any amendments to their Michigan returns as the Internal Revenue Service IRS confirmed it. Over 50 Million Returns Filed 48 Star Rating Claim all the credits and deductions. President Bidens recent federal American Rescue Plan Act excludes unemployment benefits of up to 10200 from income in the 2020 tax year for taxpayers falling.

Heres everything you need to know about the IRS unemployment refunds including what to do if youve already filed your taxes. This Notice addresses the unemployment compensation exclusion also unemployment exclusion in the federal American Rescue Plan Act and its effect on the taxable income of Michigan resident taxpayers under the Michigan Income Tax Act. The Michigan Department of Treasury is urging taxpayers to file amended Michigan individual income tax returns if they have already filed without reporting unemployment compensation exclusions for the 2020 tax year.

Michigan residents who lost their jobs in 2020 and filed their state income tax returns early this year need to file an amended state return to get extra cash back from a new tax break. Include all forms and schedules previously filed with your original return. See How Long It Could Take Your 2021 State Tax Refund.

If youre married and filing jointly you can exclude up to 20400. If Michigan tax was withheld you would have to file a Michigan return to get a refund of the Michigan withholdings. Theres a flat 425 tax on most income in Michigan.

You may check the status of your refund using self-service. Taxpayers who may have anticipated owing taxes may now be entitled to a refund or a lesser payment. Michigan residents now are looking at an extra long delay in receiving key tax paperwork from the state Unemployment Insurance Agency.

The federal American Rescue Plan Act excludes unemployment benefits up to 10200 from income for tax year 2020 for those within certain income brackets providing tax relief on both federal and state income taxes. Include schedule AMD which captures the reason why you are amending the return. Michigan unemployment officials say 12 million residents about 25 percent of the states labor force should receive a 1099 tax form by the end of February a month late so they can file annual income taxes.

But even as workers await the document the state has yet to decide whether thousands of jobless workers will have to repay up. The federal American Rescue Plan Act was signed into law on March 11 2021. Adjusted Gross Income AGI or Total Household.

Allow 2 weeks from the date you received confirmation that your e-filed state return was accepted before checking for information. To complete properly check Box N and on line 8 Explanation of changes please write Federal Unemployment Exclusion.

Michigan Department Of Treasury Don T Wait To File Your Individual Income Tax Returns

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Tax Refunds 2022 Why Did You Only Get Half Of Your Tax Return Marca

Income Tax Why Do We Pay Federal Income Tax H R Block

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

:max_bytes(150000):strip_icc()/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment

How Is Tax Liability Calculated Common Tax Questions Answered

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

Michigan Department Of Treasury Treatment Of 2020 Unemployment Compensation Exclusion Senter Cpa P C

Michigan S Delayed 1099 G Unemployment Tax Forms Now Available Online Mlive Com

This Annual Tax Reference Guide Is For Any Business That Has Employees And Contractor Bookkeeping Business Small Business Accounting Small Business Bookkeeping

How Do Income Taxes Affect The Economy Tax Foundation

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

Money Monday How To Get Taxes Back On Michigan Unemployment Payments

Inicio Mi Pareja Mi Espejo Self Help Online Security Self

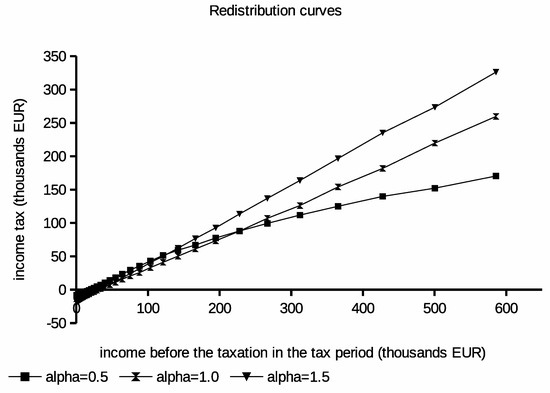

Jrfm Free Full Text Application Of Genetic Algorithm To Optimal Income Taxation Html