massachusetts estate tax table 2021

An estate valued at exactly 1 million will be taxed on 960000. Up to 25 cash back The Massachusetts tax is different from the federal estate tax which is imposed only on estates worth more than 1206 million for deaths in 2022.

The graduated tax rates are capped at 16.

. For 2021 Schedule E-3. 625 state sales tax 1075 state excise tax up to 3 local option for cities and towns Monthly on or. Massachusetts H2881 2021-2022 By Mr Dooley of Norfolk a petition accompanied by bill House No 2881 of Shawn Dooley and others relative to the estate tax code of the.

The estate tax rate is based on the value of the decedents entire taxable estate. A local option for cities or towns. Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021.

2021-2022 Federal Estate Tax Rates. You skipped the table of contents section. This is why residents whose estates hover around the 1 million mark have to be especially careful.

If you live and die in Massachusetts and own a home a. So even if your. 18 0 base tax 18 on taxable amount.

Download or print the 2021 Massachusetts Form M-706 Estate Tax Return for FREE from the Massachusetts Department of Revenue. 50 personal income tax rate for tax year 2021. Massachusetts Resident Income Tax Return.

This tool is provided to help estimate potential estate taxes and should not be relied upon without the assistance of a qualified estate tax professional. Mississippi state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with MS tax rates of 0 3 4 and 5 for Single Married Filing Jointly Married. Starting in 2023 it will be a 12 fixed rate.

In 2022 Connecticut estate taxes will range from 116 to 12. Unlike most estate taxes the Massachusetts tax is applied to the entire estate not just any amount that exceeds the. The Massachusetts estate tax is a little-understood tax that impacts middle-class families in our fair state every year.

A state sales tax. For tax year 2021 Massachusetts has a 50 tax on both earned salaries wages tips commissions and unearned interest. Take a look at.

A state excise tax. Estate Trust REMIC and Farm Income and Loss. The tax rate ranges from 116 to 12 for 2022.

How Is Tax Liability Calculated Common Tax Questions Answered

Irs Announces Higher Estate And Gift Tax Limits For 2020

Eight Things You Need To Know About The Death Tax Before You Die

Massachusetts Estate Tax Everything You Need To Know Smartasset

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Massachusetts Estate Tax Everything You Need To Know Smartasset

Massachusetts Estate Tax Everything You Need To Know Smartasset

Massachusetts Estate And Gift Taxes Explained Wealth Management

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

A Guide To Estate Taxes Mass Gov

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

States With No Estate Tax Or Inheritance Tax Plan Where You Die

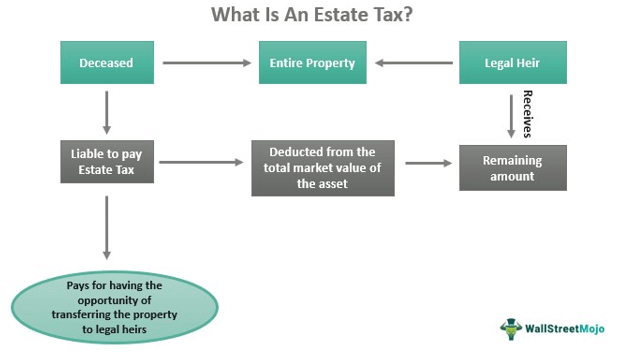

Estate Tax Meaning Exemption 2021 22 Vs Inheritance Tax

State Corporate Income Tax Rates And Brackets Tax Foundation

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Inheritance Tax Here S Who Pays And In Which States Bankrate

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

:max_bytes(150000):strip_icc()/taxes-4188113-final-1-650f90dd44bf47c1bf1fb75727a58565.png)